"dubious" information. "Re-he-he-heaalllly?"

"dubious" information. "Re-he-he-heaalllly?"Bernake speaks in Jacksonville

"Bernanke defended the Fed's decision earlier this week to buy $600 billion in government bonds to push interest rates even lower. Some critics worry that the move will be inflationary."

"Sometimes you hear the Fed is printing money. That's not happening," he said.

So... we just had $600 billion laying around in reserve for a rainy day? Just like we had $1.7 trillion laying around in March of 2009? Hmm

m. To quote Desi Arnaz Ben, "Lucy, you've got some splainin' to do!" The world bank chief is calling for a new gold standard based currency, as nations are losing faith in the U.S.peso dollar.

m. To quote Desi Arnaz Ben, "Lucy, you've got some splainin' to do!" The world bank chief is calling for a new gold standard based currency, as nations are losing faith in the U.S.peso dollar."Gold briefly hit a record high of $1,398.35 an ounce in early trade on Monday on concerns of a continued weakening dollar trend after the U.S. Federal Reserve last week acted to resume buying Treasuries.

SUMMIT ACRIMONY?

That policy has fed acrimony among leading economies in the Group of 20 in the run-up to their summit in Seoul on Wednesday and Thursday.

China and Germany, major exporting nations, have both decried the Fed's quantitative easing -- effectively printing money -- which is weakening the dollar."

China, Russia slam Fed move

Washington has frequently criticized China, saying it deliberately undervalues its currency to boost exports.

China says the United States, via the Fed, is engaged in the same thing that it stands accused of, and some emerging nations have already acted to curb their currencies' rise.

Resentment abroad stems from worry that Fed pump-priming will hasten the U.S. dollar's slide and cause their currencies to shoot up in value, setting the stage for asset bubbles and making a future burst of inflation more likely.

"As a major reserve currency issuer, for the United States to launch a second round of quantitative easing at this time, we feel that it did not recognize its responsibility to stabilize global markets and did not think about the impact of excessive liquidity on emerging markets," Chinese Finance Vice Minister Zhu Guangyao said on Monday.

The Fed's quantitative easing policy was unveiled last week to jeers from emerging market powerhouses from Latin America to Asia. Russia renewed its assault on Monday.

The Dollar

has the had the same trajectory as the Titanic post-iceberg since 1985, losing a whopping 55% of it's value, with two huge downdrafts in March of 2009 ($1.7 Trillion in "reserves") and August 2010 (We still have at least $500 billion in "reserves" Jackson Hole speech). Every finance minister from s

has the had the same trajectory as the Titanic post-iceberg since 1985, losing a whopping 55% of it's value, with two huge downdrafts in March of 2009 ($1.7 Trillion in "reserves") and August 2010 (We still have at least $500 billion in "reserves" Jackson Hole speech). Every finance minister from s ea to shining sea is blasting the Fed for printing money. Ben says he's not printing money. Hmmmmmm...

ea to shining sea is blasting the Fed for printing money. Ben says he's not printing money. Hmmmmmm...Addendum: 12/9/10

Hey don't take my word for it...take BEN's word for it! (Thanks John Stewart!)

| The Daily Show With Jon Stewart | Mon - Thurs 11p / 10c | |||

| The Big Bank Theory | ||||

| ||||

“The best way to destroy the capitalist system is to debauch the currency. By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

—John Maynard Keynes

d

Most people I know feel like our friend here when it comes to finances. No matter how fast you run or how hard you work, you can't seem to get ahead. If you weren't pissed off about the bailouts, Wall Street's record bonuses last year and

Most people I know feel like our friend here when it comes to finances. No matter how fast you run or how hard you work, you can't seem to get ahead. If you weren't pissed off about the bailouts, Wall Street's record bonuses last year and

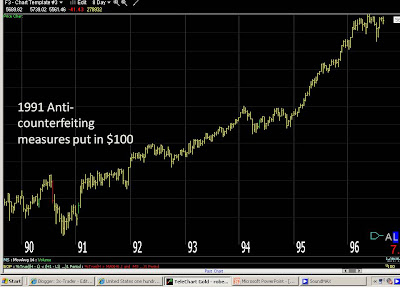

You might have caught in the local news that we've got a spanking new C-note coming out. The company line is it's to prevent counterfeiting. We're talking you North Korea and Iran. Anyhow I couldn't help but wonder if the new $100 had more to do with the fact we just printed up over 2 TRILLION of them to get that pesky stock market to quit going the wrong way.

You might have caught in the local news that we've got a spanking new C-note coming out. The company line is it's to prevent counterfeiting. We're talking you North Korea and Iran. Anyhow I couldn't help but wonder if the new $100 had more to do with the fact we just printed up over 2 TRILLION of them to get that pesky stock market to quit going the wrong way.