You might have caught in the local news that we've got a spanking new C-note coming out. The company line is it's to prevent counterfeiting. We're talking you North Korea and Iran. Anyhow I couldn't help but wonder if the new $100 had more to do with the fact we just printed up over 2 TRILLION of them to get that pesky stock market to quit going the wrong way.

You might have caught in the local news that we've got a spanking new C-note coming out. The company line is it's to prevent counterfeiting. We're talking you North Korea and Iran. Anyhow I couldn't help but wonder if the new $100 had more to do with the fact we just printed up over 2 TRILLION of them to get that pesky stock market to quit going the wrong way.First, a little history so you can read along yourself. Here's the low down on the C-note, and not coincidentally it's also the history of bailing out our fi

nancial oligarchs when they make bad bets at the parlor.

nancial oligarchs when they make bad bets at the parlor. Watch and be amazed at the world's most advanced Ponzi Scheme. Pay special attention to this paragraph in the Ponzi definition:

"Knowingly entering a Ponzi scheme, even at the last round of the scheme, can be rational economically if there is a reasonable expectation that government or other deep pockets will bail out those participating in the Ponzi scheme."

On Main St. the Ponzi implodes when too many people want their money back. Not this bad boy...we just print Mo' Money to pay off those who want it, and once the supply of panicked sellers is exhausted away we go to the upside. The peasants wind up having to pay more for EVERYTHING, since the currency value just went down by the amount printed, but that's a small price to pay for saving "The System". We're reminded nightly of "How bad things could've been" if we'd let the slide continue. The reality is we won't get the chance to find out, until the final collapse of our currency (which will be blamed on something other than Keynesianism Gone Wild). There's always a new Fed chief in shining armor that spent 14 years at Princeton learning how turn on a printing press, enabling  what has become a parasitic banking system to continue sucking the life out of our middle class while grossly enriching themselves in FDIC insured Casinos. You'll never hear that on the TV since the major networks are wholly owned subsidiaries of said banks. The ultra-wealthy won't lose money or power as long as the bottom 90% of America is willing to keep picking up the tab. This fiat money system is da BOMB when you're at the top!

what has become a parasitic banking system to continue sucking the life out of our middle class while grossly enriching themselves in FDIC insured Casinos. You'll never hear that on the TV since the major networks are wholly owned subsidiaries of said banks. The ultra-wealthy won't lose money or power as long as the bottom 90% of America is willing to keep picking up the tab. This fiat money system is da BOMB when you're at the top!

History of the $100 bill

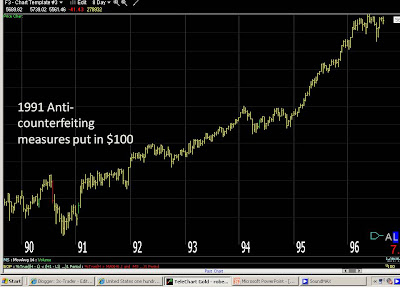

Here is the history of the $100 along with the Dow Jones Industrial Average. Behold the power of the printing press...

The Dow Chart doesn't go back that far, but we can see we're coming up from somewhere much lower in 1914.

45% decline from 1919-1922. Decline halted.

A 50% drop in two months, as the "wealth effect" from 1922 flames out. It's not enough, however.

Unable to stop the slide, FDR makes Joe Kennedy chairman of the SEC. An experienced inside trader and market manipulator, this unlimited power allows him to halt the 90% stock slide via the printing press, but the recession wears on until WWII.

Unable to stop the slide, FDR makes Joe Kennedy chairman of the SEC. An experienced inside trader and market manipulator, this unlimited power allows him to halt the 90% stock slide via the printing press, but the recession wears on until WWII.

The fact the rest of the world's industrial capacity was demolished in WWII, resulting in America being the "last man standing" and pulling our REAL economy out of recession has been lost. Now it's FDR's adoption of John Maynard Keynes visionary monetary policies that did the job. Hey, why don't we try that just to make things go UP?

The fact the rest of the world's industrial capacity was demolished in WWII, resulting in America being the "last man standing" and pulling our REAL economy out of recession has been lost. Now it's FDR's adoption of John Maynard Keynes visionary monetary policies that did the job. Hey, why don't we try that just to make things go UP?

what has become a parasitic banking system to continue sucking the life out of our middle class while grossly enriching themselves in FDIC insured Casinos. You'll never hear that on the TV since the major networks are wholly owned subsidiaries of said banks. The ultra-wealthy won't lose money or power as long as the bottom 90% of America is willing to keep picking up the tab. This fiat money system is da BOMB when you're at the top!

what has become a parasitic banking system to continue sucking the life out of our middle class while grossly enriching themselves in FDIC insured Casinos. You'll never hear that on the TV since the major networks are wholly owned subsidiaries of said banks. The ultra-wealthy won't lose money or power as long as the bottom 90% of America is willing to keep picking up the tab. This fiat money system is da BOMB when you're at the top!History of the $100 bill

Here is the history of the $100 along with the Dow Jones Industrial Average. Behold the power of the printing press...

The Dow Chart doesn't go back that far, but we can see we're coming up from somewhere much lower in 1914.

45% decline from 1919-1922. Decline halted.

A 50% drop in two months, as the "wealth effect" from 1922 flames out. It's not enough, however.

Unable to stop the slide, FDR makes Joe Kennedy chairman of the SEC. An experienced inside trader and market manipulator, this unlimited power allows him to halt the 90% stock slide via the printing press, but the recession wears on until WWII.

Unable to stop the slide, FDR makes Joe Kennedy chairman of the SEC. An experienced inside trader and market manipulator, this unlimited power allows him to halt the 90% stock slide via the printing press, but the recession wears on until WWII. The fact the rest of the world's industrial capacity was demolished in WWII, resulting in America being the "last man standing" and pulling our REAL economy out of recession has been lost. Now it's FDR's adoption of John Maynard Keynes visionary monetary policies that did the job. Hey, why don't we try that just to make things go UP?

The fact the rest of the world's industrial capacity was demolished in WWII, resulting in America being the "last man standing" and pulling our REAL economy out of recession has been lost. Now it's FDR's adoption of John Maynard Keynes visionary monetary policies that did the job. Hey, why don't we try that just to make things go UP?

No, the founding fathers did not put that on our currency notes. Those asshole athiests are actually right about that.

A 40% drop in three months? Let's print some cash with "God" on it. "Ponzi on Wayne!" Also, Lloyd Blankfein was born. Ok I made the last part up.

A 40% drop in three months? Let's print some cash with "God" on it. "Ponzi on Wayne!" Also, Lloyd Blankfein was born. Ok I made the last part up.

Hey, things are going OK! Don't you think they'd be better if we had more money though? We'll pass it off as "anti-counterfeiting" measures.

Note how we've evolved into printing money to make things go up, not just stop them from going down. Man this is great! Who cares if milk is now $4 a gallon! You know what'd be even BETTER? Let's get rid of that stupid Glass Steagall Law!

Note how we've evolved into printing money to make things go up, not just stop them from going down. Man this is great! Who cares if milk is now $4 a gallon! You know what'd be even BETTER? Let's get rid of that stupid Glass Steagall Law!

We managed to halt the 2000 bear market with only 1% interest rates for the big banks for four years. I'm sure that'll turn out..oh crap. Housing bubble.

Ok..our private economy is in big trouble. It's 70% consumption driven, but the consumption is credit driven. With little to no savings for many it's one credit bubble to the next, in the final chapters of "kick the can". This decline halted with 2.2 trillion in printing and 20 trillion at the discount window. Bankers are doin AH-ight with that it seems. Financial firms report 40% rise in bonuses worldwide Main Street keep paying your mortgages by the way.

A family of four now has a very difficult time making ends meet on $70,000 per year. That's about what Wall St executives spend on shower curtains annually. I'm sure glad "The System" is still intact.

"I conceive that the great part of the miseries of mankind are brought upon them by false estimates they have made of the value of things."

-Benjamin Franklin

"Experience demands that man is the only animal which devours his own kind, for I can apply no milder term to the general prey of the rich on the poor."

-Thomas Jefferson