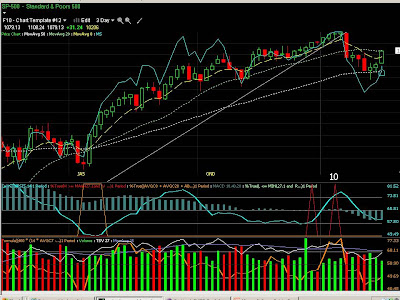

Here we have the SP-500 for the last 10 years (click for bigger). Points A and B are roughly 10 years apart. If you went all in long the index in 1998 and made it through the last 12 years without hitting the

"SELL" button, you'd have made..zero. And burned through several cases of Rolaids in the meantime. Same thing if you'd shorted the index. The big

$ signs represent Federal Stimulus efforts. The technical bear case for the chart is evident, as you'll find that double-top formation in chapter 1 of every trading book ever written. What you won't find often is a confirmed double top on a 25-year chart of the U.S. economy, which is what this represents.

Chart patterns bust though, so I scratch around for some bullish evidence that point B (which I'm biased towards because it's now) is really waaay better than point A. That's where the involuntary nervous tic in my left eye starts..

In 1999 median household income was $50,641 and the national debt was about $5.65 trillion.

In 2007 median income was $50,233, and the national debt was about $9.1 trillion.

Knowing what's happened to household incomes, employment, home values, savings and the national debt since 2007, you might start developing a nervous tic as well...and thinking that putting all your savings at the offices of Madoff,Stanton,Stearns and Lehman might not be the way to go for financial freedom. Or solvency for that matter. I believe this dynamic has created the leveraged ETF explosion..where volatility is the game and you can attempt to make money while the real economy and stock market goes nowhere..fast.

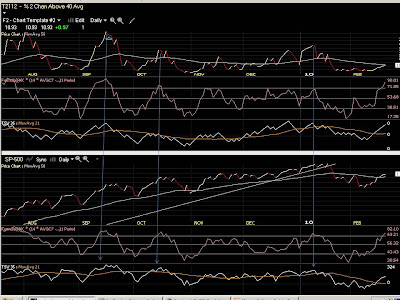

Telechart T2112, the % of stocks trading 2 standard deviations above their 40-day PMA. This is what "Overbought" looks like, and I'm looking to short here or at the very least not go long, as a selloff is near. Keep in mind most of these moves are of 5% or more on the SP-500, even though it might not look like much on the chart.

Telechart T2112, the % of stocks trading 2 standard deviations above their 40-day PMA. This is what "Overbought" looks like, and I'm looking to short here or at the very least not go long, as a selloff is near. Keep in mind most of these moves are of 5% or more on the SP-500, even though it might not look like much on the chart. Telechart T2116, indicating the % of stocks 2 standard deviations BELOW their 40-day price moving average. When you hear the term "Oversold" from an analyst, this is what it looks like. Note the correlation between spikes in this indicator and sharp reversals in the SP-500 in the bottom half of the chart. You should be getting long here, or at the least not shorting, as a rally's approaching.

Telechart T2116, indicating the % of stocks 2 standard deviations BELOW their 40-day price moving average. When you hear the term "Oversold" from an analyst, this is what it looks like. Note the correlation between spikes in this indicator and sharp reversals in the SP-500 in the bottom half of the chart. You should be getting long here, or at the least not shorting, as a rally's approaching. DRN Fibonacci retracement into 50-61.8% zone

DRN Fibonacci retracement into 50-61.8% zone MSCI REIT index that DRN tracks approaching price resistance. Note the Stochastics in the middle are indicating downtrend(red line above green) so this play is technically with the trend

MSCI REIT index that DRN tracks approaching price resistance. Note the Stochastics in the middle are indicating downtrend(red line above green) so this play is technically with the trend SP-500 PUVD shows up well on the 3-day

SP-500 PUVD shows up well on the 3-day T2108 no longer oversold

T2108 no longer oversold T2106 overbought

T2106 overbought REIT bollinger band resistance

REIT bollinger band resistance